Conagra Brands Stock Falls as it Warns About a Challenging Consumer Environment

David Paul Morris / Bloomberg via Getty Images

Birds Eye is one of Conagra's brands.Key Takeaways

Conagra Brands gave a disappointing fiscal 2025 outlook, citing a tough consumer environment.

The processed food company said it expects the consumer to remain challenged in the fiscal year ahead.

Conagra posted better-than-expected profit in its fiscal 2024 fourth quarter, although revenue declined.

Conagra Brands (CAG) shares fell Thursday as the processed food giant gave weaker-than-expected guidance amid what it called a “difficult consumer environment.”

The provider of brands such as Birds Eye and Slim Jim said it sees fiscal 2025 adjusted earnings per share (EPS) in a range of $2.60 to $2.65, below estimates. It anticipates organic revenue to be flat to down 1.5% from this year.

CEO Sean Connolly said the company believes “the consumer will remain challenged" in its fiscal 2025 year, but that it would "gradually transition toward a more normalized operating environment as consumers adapt.”

The downbeat outlook came as Conagra reported fiscal 2024 fourth quarter adjusted earnings EPS of $0.61, better than forecasts. Revenue fell 2.3% to $2.91 billion.

Weighing on net sales, the company said, was “a decrease in volume, primarily due to continued lower consumption trends.”

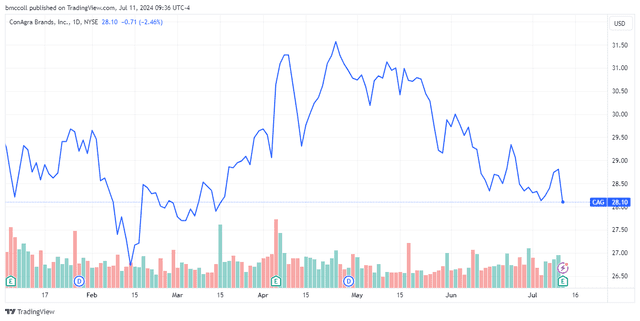

Shares of Conagra Brands fell 2.4% as of about midday.

TradingView

Read the original article on Investopedia.