Prosus is testing waters in early stage investing in India after some major bets in Indian startups like BYJU’S, Pharmeasy having backfired while a few other portfolio startups reeling under losses

Prosus this year marked its first seed stage investment in India and has also rejigged its top brass to execute early stage investments

As VCs write the new playbook, analysts say that large ticket deals will be delayed than before

Prosus, one of the most active investors in the Indian startup ecosystem, is gradually undergoing a shift in its India strategy. The Dutch investment major’s focus has turned from large bets and buyouts in India to seed and early stage investments.

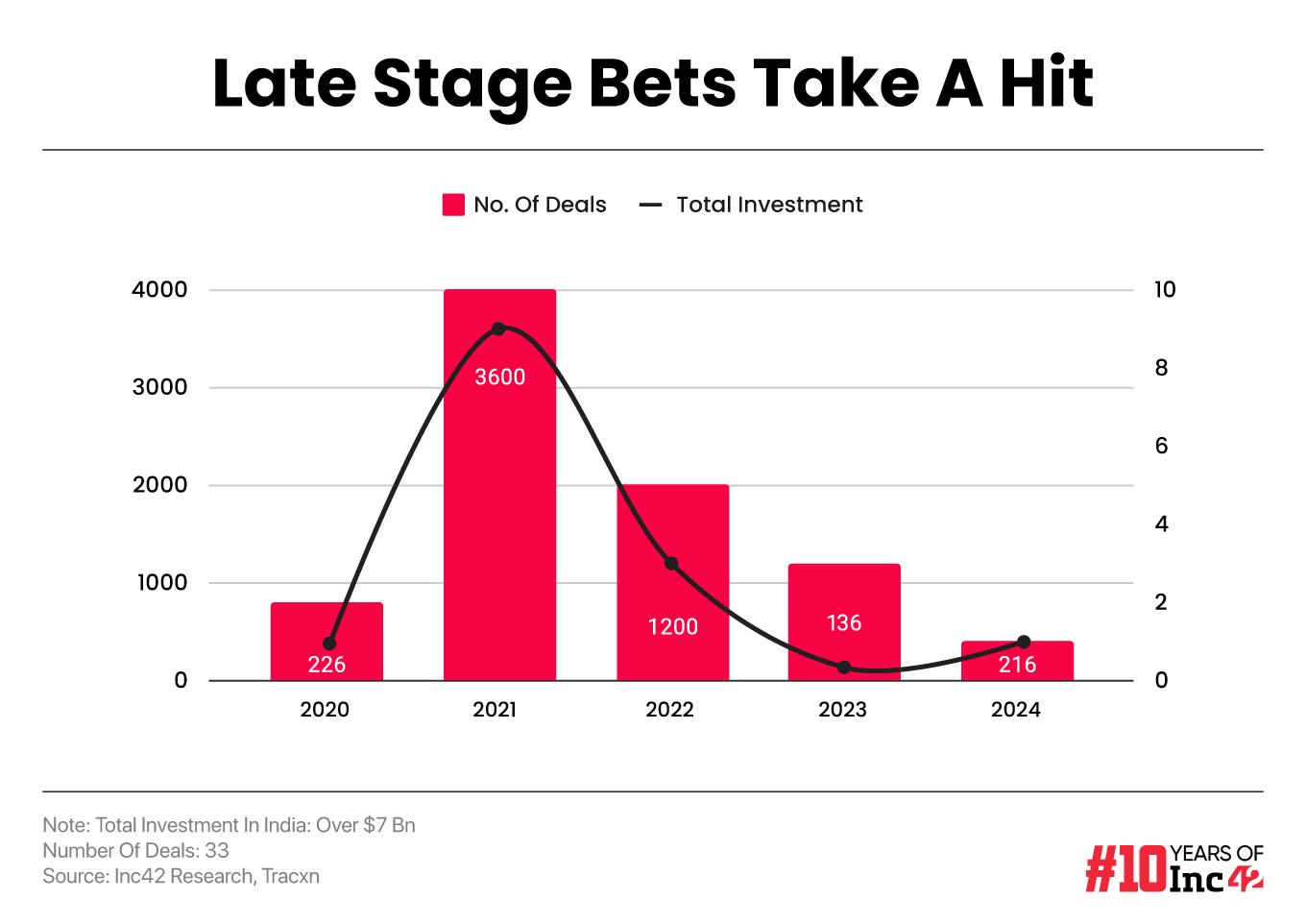

Notably, Prosus has poured in more than $7 Bn into Indian startups so far, according to data from Inc42 and Tracxn, mostly through large ticket sizes and investments in unicorns such as Swiggy, Meesho, Pharmeasy, The Good Glamm Group, Urban Company among others.

The investment giant’s volume of large deals has fallen consistently since 2021 from 10 deals to five such deals in 2022 and then 3 in 2023, and just the one late stage deal in 2024. In contrast, Prosus had invested in more Series A rounds in the past few years than ever before — two in 2021, five in 2022 and another deal in 2023.

In February 2023, Prosus took a seed stage bet for the first time in India, when it invested in Bengaluru-based Kratos Studios in an INR 160 Cr round. Prosus also participated in the $26 Mn seed round for Gurugram-based lifestyle platform Lyscraft, where Peak XV was the lead investor.

The VC giant has also turned its focus to investments in AI platforms such as EMA, where it invested in a $35 Mn seed round along with Accel and others. Besides India, Prosus also entered seed stage deals in Australia and the US, with a total of six seed stage deals since February 2023.

This apparent shift in strategy comes on the heels of Prosus having rejigged its top brass in India with Ashutosh Sharma (since April 2024) now overseeing investments in India and Southeast Asia.

The investment group is also undergoing a leadership change for its global operations, as iFood chief executive Fabricio Bloisi took over as CEO and head at Naspers and Prosus in May, 2024. Incidentally, iFood is part of Prosus’ portfolio in Brazil and reported $96 Mn in operating profits in FY24.

Prosus’ Large Bets Tank

It’s not just Prosus, of course. We have written about marquee investors such as Tiger Global, Accel and Peak XV Partners going through a similar downturn in their respective portfolios. While Peak XV has seen plenty of exits from public listings, it must be noted that the majority of the startups in its portfolio are still loss-making.

Just like Tiger Global and Peak XV, Prosus too has taken a shine to early-stage investments, competing and collaborating with other early-stage investors.

In contrast to the success of some of its non-Indian bets such as iFood and OLX Group, Prosus is having a tougher time in India.

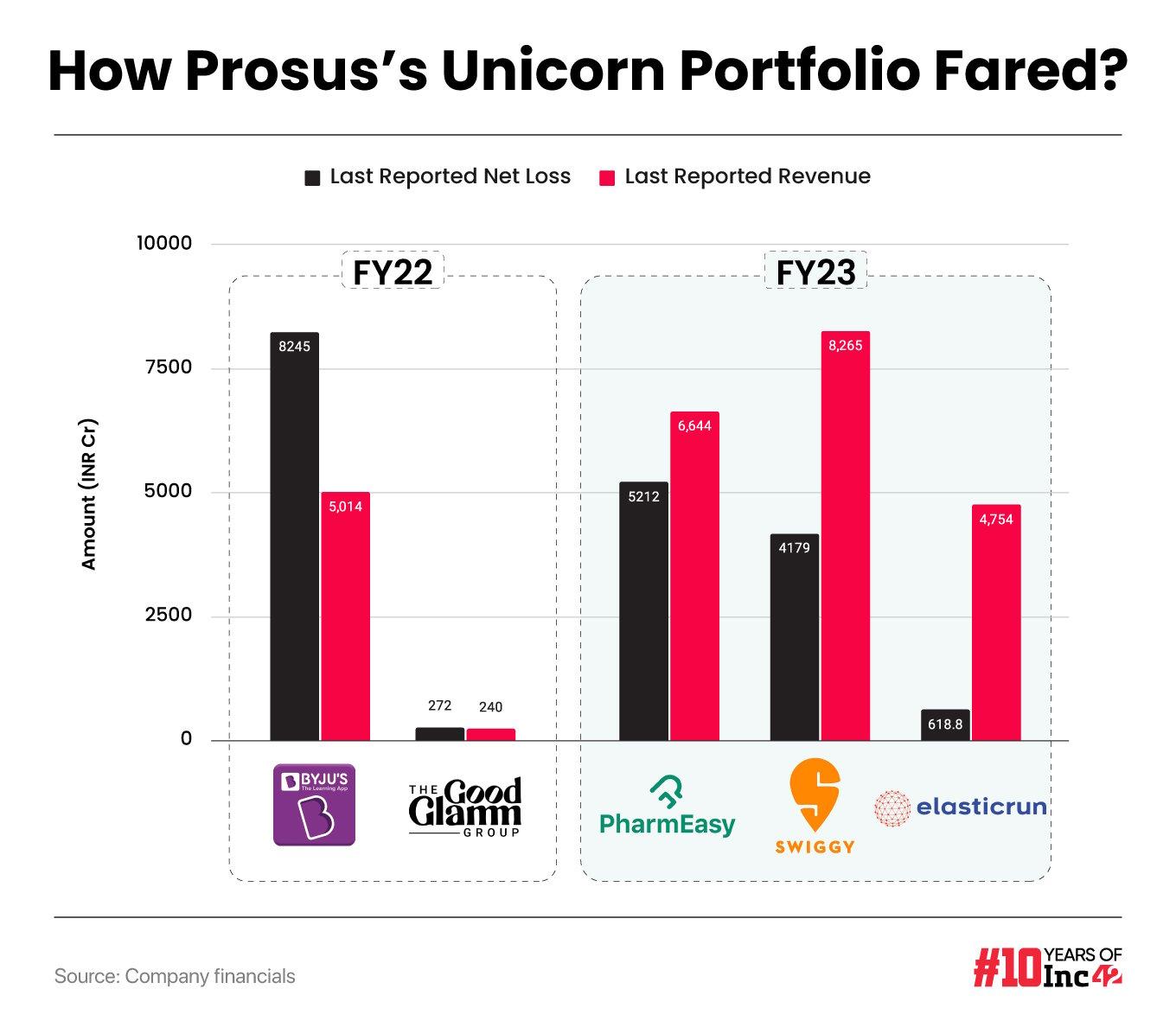

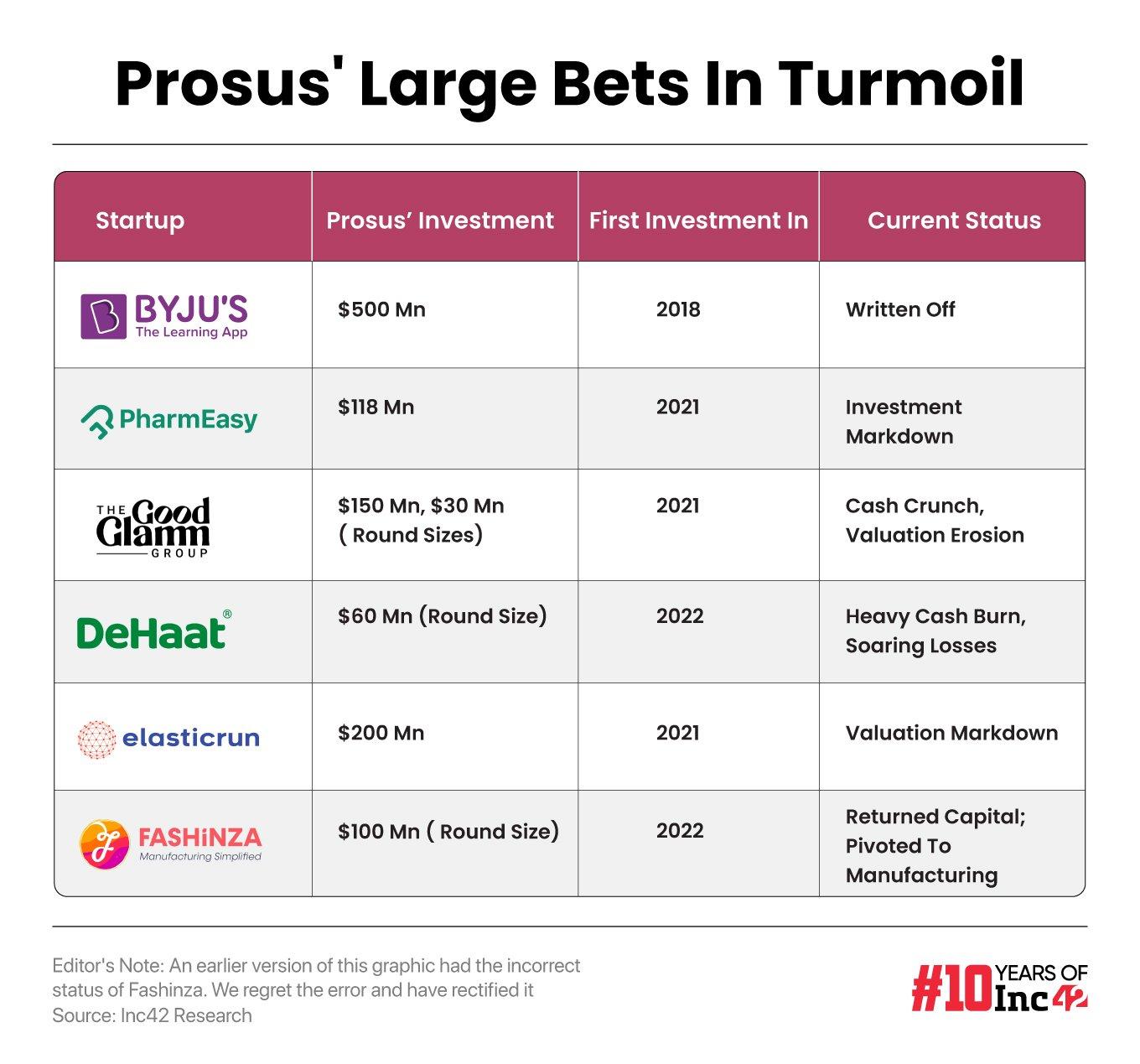

The biggest dent in Prosus’ India plans has come from BYJU’S, a $500 Mn+ investment which has now been written off. Besides this, the likes of Swiggy, Pharmeasy, Meesho, The Good Glamm Group and others in its India portfolio are grappling with losses, with Urban Company being an exception of sorts.

The $118 Mn investment in Pharmeasy, as per an earlier statement, has also been marked down, and Prosus was left with no option other than to participate in Pharmeasy’s rights issue this year which valued the company at a 90% discount.

Fashion ecommerce marketplace Fashinza, where Prosus co-led a $100 Mn funding round in 2022, is now reportedly planning to return money to its investors after its business model found no footing.

The investor also wrote off its $38 Mn investment in Zestmoney last year, when the company shut down due to operational challenges.

Further, Prosus’ only agritech bet in India, Dehaat in which the investor holds a 11.1% stake, is challenged with cash flow, internal control issues with losses having soared by 94% to INR 371 Cr in FY23 as the overall B2B marketplaces witness a sluggish growth.

Hopes Rest On IPOs

Coming back to Prosus, the investment giant will be eagerly looking forward to the IPOs of Swiggy, Eruditus and PayU India as a silver lining in these dark clouds. However, it must be noted that neither of these three companies are profitable as of their last reported financials.

Prosus’ interim CEO Ervin Tu had earlier stated that PayU India was IPO-ready and looking to list on stock exchanges in the latter half of 2024. The Dutch investor is also banking on PayU-operated LazyPay’s lending biz in India which is looking to pilot SME loans besides the existing consumer loans vertical.

Swiggy, which has gone for a confidential pre-IPO filing route, is also expected to list by the end of the year. The food delivery and quick commerce giant is expected to cross INR 10,000 Cr (~$1.25 Bn) in revenue for FY24, as reported by Inc42 earlier, but the company is likely to remain in losses despite this revenue milestone. Swiggy has claimed that its food delivery business turned profitable in FY23.

Prosus also holds around 12% stake in Singapore-domiciled edtech startup Eruditus which is in the process of reverse flipping to India before a potential IPO. The edtech firm has reported a revenue of $400 Mn in FY23 with improvement in adjusted EBITDA losses to INR 422 Cr in FY23 from INR 1,288 Cr in FY22.

As per investors and fund managers that we spoke to, the thesis for late-stage investments is built around exit horizons of 4-5 years. This is in stark contrast to early-stage investing, which is often called patient capital.

For any large investor like Prosus, the stakes are considerably higher when it comes to such late-stage bets. Particularly because exits through secondary sales are less feasible at this stage. So the dependence on public listing is higher for investors such as Prosus.

Pratekk Agarwaal, founder and general partner at GrowthCap Ventures, believes institutional investors such as Prosus, which typically holds more than 10% stake in a startup, are bound to protect their capital interests by pushing for exits.

In fact, Swiggy (where Prosus owns a 33% stake) was given an IPO deadline for 2024, which led to a series of cost-cutting measures in FY23 and FY24, including layoffs, restructuring of verticals, and curbing of marketing expenses.

Unlike Swiggy, which is close to turning around its losses as per sources in the company, the likes of BYJU’S and Pharmeasy are the more bitter pills that Prosus has to swallow. Here, the path to an IPO has been delayed indefinitely as these startups will first look to keep their business afloat, improve their cash flow health, before even considering a public listing.

“The times are tough for founders and large investors alike. With late-stage deals, there has to be a good amount of conviction around the certainty of exit options. The value erosion in companies coupled with weak public market sentiments for loss-making startups have delayed IPO timelines. And at the same time there were questions posed around their profitability and corporate governance lapses,” Mitesh Shah, cofounder of Inflection Point Ventures and partner at Physis Capital, added.

According to him, when these companies were raising large amounts of capital in Series C, D rounds during the funding peak of 2021, investors were convinced they would also reach profitability on the back of growing behaviour of online consumer consumption of products and services. But the downturn of the past two years and the consequent drop in consumer spending outside the metros changed this tune.

FOMO Comes Back To Bite VCs

In the case of Prosus, the firm turned its focus from China to India due to overriding regulatory concerns in China in 2022 trying to divest its 25% stake in Chinese ecommerce giant, Tencent. Prior to that Prosus listed on Amsterdam and Johannesburg stock exchanges in 2019 with Naspers as a majority shareholder and the rest owned by the public investors.

But as GrowthCap’s Agarwaal pointed out that markets have changed drastically in a period of 2-3 years. ���In each sector today, we have one or two major players who now have more than 80% of the market share and revenue. This wasn’t the case in 2020 or 2021. Funds which had raised plenty of capital in the post-Covid zero interest rate policy regimes looked to bet big on dozens of deals. You can say there was a FOMO among investors back then, which is gone now,” he added.

Indeed, there has been plenty written about corporate governance lapses, reckless expansion and acquisitions fuelled by VC money and even fraud which have dented the investor faith in late-stage bets to some extent.

According to Navin Honagudi, founder and managing partner of growth stage fund Elev8 Partners, identifying profitable companies for VCs was a herculean task back in 2021. The market was uncertain and there was a likelihood that many of the companies that raised funds would break through and turn profitable.

But now, there is a demand-supply gap in the late-stage startup ecosystem with companies chasing capital and investors staying away from uncertain business models.

As one founder of a growth-stage B2B ecommerce marketplace sheepishly told us, fund managers are being pressured by their limited partners to take cautious bets and they would rather have VC firms sit on the accumulated dry powder, than enter large ticket deals quickly.

The alternative for large VC funds is early-stage investing, or chasing emerging areas in India such as AI development, semiconductor manufacturing and other deeptech segments.

Besides Prosus, we have seen the likes of Tiger Global, Peak XV Partners, Accel and others jump into the early stage bandwagon. While Peak XV has Surge, Accel has launched Accel Atoms — dedicated platforms for early-stage investments. Prosus or Tiger Global do not have such platforms but their early stage deal volume has grown significantly in India from 2022.

According to some fund managers we spoke to, large VCs are now averaging out their losses by building larger portfolios rather than banking on select founders or startups for returns.

“The bigger VCs are testing early-stage markets and writing $3 Mn-$5 Mn cheque sizes for 20%-25% stake in startups, where they can stay invested for the long term. They are hedging bets between early and late investments,” GrowthCap’s Agarwaal added.

Elev8 Partners’ Honagudi believes this swing to the early stage is part of a market cycle, where larger funds managing billions of dollars in AUMs look to have the right kind of mix in their portfolios. “This happens once in 2-3 years when markets evolve,” he added.

Others believe that early-stage deals offer far more flexibility to investors who can double down on emerging technology and startups in these areas. This also allows funds to direct operations or business models which is not always possible with late-stage firms.

“As an investor, your ability to take risk at an early stage is much higher. Plus we can manoeuvre around any risk in the business model and in case of success, the returns will be much higher. You also can derisk your portfolio by betting on more startups rather than focussing on the handful of late stage startups in the portfolio, which may not deliver the right kind of returns,” IPV’s Shah added.

The New Playbook

One thing is for certain: investment playbooks are constantly evolving. In 2023 and 2024, deliberations between investors and founders have stretched over term sheet points, profitability metrics and other legal clauses in contracts.

“Because of extended due diligence processes, the timelines are delayed which is why the late stage funding has seen a lull. Currently I know of funds who are looking to invest only into profitable companies. Investors are definitely pushing big startups towards IPO. Moreover, startups are expected to have absolute clarity on their IPO timelines,” Honagudi of Elev8 Partners told Inc42.

Similarly, GrowthCap’s Agarwaal pointed out that protection of investor rights over dilution and corporate governance lapses such as revenue inflation or over-indebtedness have become pivotal for lead investors.

This is especially true for investors such as Prosus or other large VCs who go on to acquire more than 10% stake in late stage companies. “At that level, you want to protect the capital you are investing, and hence investors now wish to scrutinise every detail minutely, which is only fair. We have seen many conditions now being put into discussions while signing big cheques, such as founder exit or IPO conditions, specific hiring and acquisition strategy, and sharing data with investors,” he said.

Critically, vanity metrics such as gross merchandise value (GMV) or downloads or pageviews have been now replaced by more dependable metrics — revenue, monetisable user base, cash reserves, cash flow among others.

Even as VCs shift their focus to early-stage bets, late-stage deals are slowly springing back to life. Flipkart raised a large round from Google; Zepto is on a funding spree, while Meesho, Lenskart, PocketFM, Rapido have also raised large rounds.

Pertinently, some of these large rounds have come after 12-24 months of hardships for many of these startups, which included layoffs, cost-cutting and scaling back from loss-making verticals. Plus, many of these companies have outlined plans to list publicly by 2026.

What will be interesting to watch is how Prosus and other VCs with billions of dollars in dry powder move forward as more and more startups turn their loss-making ships around. Will 2025 see the return of large VCs signing mega deals after the lull of the past two years?

[Edited By Nikhil Subramaniam]

Ad-lite browsing experience

Ad-lite browsing experience